Exchange-Traded Funds (ETFs) have revolutionized investing by offering diverse opportunities at lower costs and with greater flexibility than traditional mutual funds. Trading like stocks on major exchanges, ETFs provide investors with instant diversification across various asset classes, sectors, and strategies. Understanding the different types of ETFs is crucial for building a well-rounded portfolio tailored to your financial goals and risk tolerance.

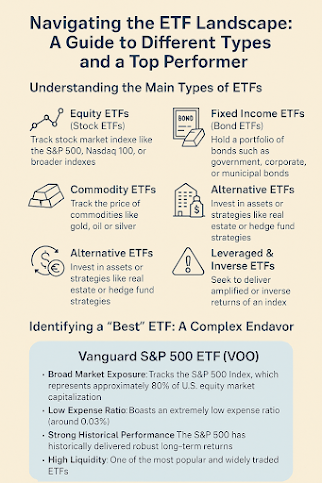

Understanding the Main Types of ETFs

ETFs can be broadly categorized based on the assets they hold and the investment strategies they employ:

Equity ETFs (Stock ETFs)

Equity ETFs are the most common type and track specific stock market indexes like the S&P 500 or Nasdaq 100. They offer exposure to a basket of stocks and can target a range of market capitalizations and geographies, including large-cap, mid-cap, small-cap, growth, or value companies.

-

Sector ETFs: Focus on specific industries such as technology, healthcare, financials, or energy, allowing investors to capitalize on particular sectors.

-

Thematic ETFs: Invest according to specific themes or trends — for example, clean energy, artificial intelligence, or cloud computing — regardless of traditional sector classifications.

Fixed Income ETFs (Bond ETFs)

These ETFs hold a diverse range of bonds, including government, corporate (investment-grade or high-yield), municipal, and international bonds. They provide income and help diversify a portfolio away from equity volatility.

Commodity ETFs

Commodity ETFs track physical assets like gold, oil, silver, or agricultural products. They can offer a hedge against inflation and diversify portfolios, often moving independently of traditional stocks and bonds. Some hold the physical asset, while others use derivatives like futures.

Currency ETFs

Currency ETFs give investors exposure to single or multiple currencies, allowing them to capitalize on foreign exchange rate movements. These can be used for hedging or speculating.

Alternative ETFs

Alternative ETFs cover a range of less traditional assets or strategies, including:

-

Real Estate ETFs (REIT ETFs): Invest in real estate investment trusts, allowing exposure to the property market without direct ownership.

-

Hedge Fund and Private Equity ETFs: Mimic the strategies of hedge funds and private equity firms, though often with limitations.

Leveraged and Inverse ETFs

-

Leveraged ETFs amplify returns of an underlying index (e.g., 2x daily returns), making them highly volatile and generally unsuitable for long-term investing.

-

Inverse ETFs profit from declining markets by providing the opposite return of an index — also highly risky and best suited for short-term trading.

Actively Managed ETFs

Unlike most ETFs that passively follow an index, these ETFs are run by portfolio managers who aim to outperform a specific benchmark. They tend to have higher expense ratios and may involve more research before investing.

Identifying a “Best” ETF: A Complex Endeavor

There is no one-size-fits-all answer to choosing the “best” ETF. The right ETF depends on your financial goals, risk tolerance, investment horizon, and market outlook. That said, a broad, diversified core holding that has historically performed well — and is often recommended for most long-term investors — is the Vanguard S&P 500 ETF (VOO).

Why VOO Stands Out:

-

Broad Market Exposure: Tracks the S&P 500 Index, representing approximately 80% of U.S. equity market capitalization.

-

Low Expense Ratio: Vanguard is known for keeping costs minimal; VOO’s expense ratio is around 0.03%, allowing investors to keep more of their returns.

-

Strong Historical Performance: The S&P 500 has historically generated robust long-term returns.

-

High Liquidity: VOO is one of the most popular ETFs, making it easy to buy and sell shares.

-

Core Portfolio Fit: Its broad diversification and low cost make VOO an ideal “core” holding for most investors.

Important Considerations

-

Past performance is not a guarantee of future results.

-

Always conduct your own research before investing in any ETF.

-

Diversification is key — a well-constructed portfolio will often also hold international equities and fixed-income investments.

-

Consult a financial advisor if you’re unsure which ETFs fit your particular situation.

Conclusion

The world of ETFs offers a rich array of investment opportunities. By learning about the types of ETFs and carefully selecting the right ones for your strategy, you can build a diversified and resilient portfolio that supports your long-term financial goals.

References

(General Information Sourced from Industry Financial Publications and Publicly Available Investment

Comments

Post a Comment