Introduction

The recent explosion of option‑overlay ETFs has spotlighted two novel players tied to MicroStrategy (MSTR) exposure:

- MSTY (YieldMax™ MSTR Option Income Strategy ETF), launched February 21, 2024

- MST (Defiance Leveraged Long + Income MSTR ETF), launched May 1, 2025

Both seek to harvest option premium against MSTR’s famed bitcoin‑linked volatility, but their structures, tax treatments, and return‑of‑capital profiles differ — shaping very different long‑term outlooks.

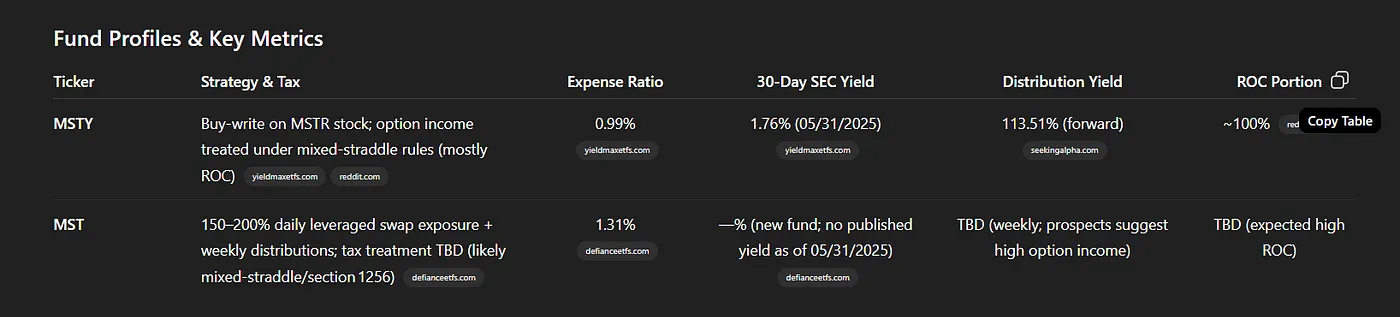

Fund Profiles & Key Metrics

- MSTY writes call options on MSTR stock, generating monthly distributions almost entirely as return of capital (ROC).

- MST leverages swap contracts and options to target 1.5–2× daily MSTR performance, paying weekly distributions but lacking a published SEC yield as of its inception date.

Tax Efficiency & Return of Capital

- Return of Capital (ROC): Both funds will likely classify the bulk of their option premiums as ROC, which:

- Defers tax by reducing your cost basis rather than triggering ordinary income.

- Erodes NAV and available capital for compounding.

- Tax Treatment Differences:

- MSTY: Option income falls under mixed‑straddle rules — virtually all distributions are ROC, deferring taxes until sale, with the non‑ROC slice taxed at ordinary rates.

- MST: May receive section 1256 treatment on certain swaps/options (60/40 tax treatment), but specifics await 19a‑1 notice filings.

5‑Year Simulation: Pre‑Tax vs. After‑Tax Total Value

To gauge long‑term impact, I projected a $100 starting investment over five years under these assumptions:

- Underlying MSTR growth: 7% annually

- Tax rates: 37% ordinary, 23.8% long‑term capital gains

- MSTY: 113.51% distribution yield (all ROC)

- MST: assumed 8% distribution yield with 95% ROC (strategy target until data emerges)

The chart below shows both NAV (dashed) and after‑tax total value including distributions (solid):

- MSTY Pre‑Tax NAV plunges quickly (huge ROC distributions), but After‑Tax Total Value stabilizes around $105, reflecting heavy basis erosion and deferred taxes.

- MST Pre‑Tax NAV declines gently (modest assumed yield), while After‑Tax climbs to roughly $127 — leveraged growth plus moderate ROC distributions allow stronger compounding.

Conclusions & Considerations

- Immediate Income vs. Compounding: MSTY’s sky‑high forward yield (≥100%) can’t overcome the drag of eroding NAV — after‑tax value barely exceeds principal after five years.

- Leverage Factor: MST’s leveraged exposure, even with a modest yield assumption, supports higher after‑tax growth, assuming underlying MSTR rallies.

- Tax Uncertainty: MST’s tax treatment details (ROC vs. 1256 gains) await formal disclosures. Investors should watch upcoming 19a‑1 notices closely.

- Risk Profile: Both ETFs concentrate in single‑stock volatility — MST adds leverage risk and compounding anomalies; MSTY is simpler but suffers NAV decay.

Note on Holding MSTY or MST in a Roth IRA

- Tax‑Free Growth & Distributions: Since Roth IRAs use after‑tax dollars, all qualified distributions — whether ordinary income, ROC, or capital gains — grow and are withdrawn tax‑free.

- No Basis Erosion Concern for Taxes: Although ROC still reduces your ETF cost basis and NAV over time, you won’t owe taxes on that basis reduction or any future gains when you take qualified Roth distributions.

- Watch for UBTI: If MST uses leveraged swaps that generate Unrelated Business Taxable Income, your IRA could face its own tax liability; check each fund’s 19a‑1 notice for any UBTI disclosures.

For an authoritative overview directly from the source, see the IRS’s guide on Unrelated Business Income Tax:

Bottom Line: For pure income in tax‐advantaged accounts, MSTY may appeal — but taxable investors should anticipate deferred tax and capital erosion. MST’s leveraged structure offers higher long‐run after-tax growth in this scenario, though it carries greater complexity and risk. Always align ETF choice with your tax bracket, account type, and risk tolerance.

Disclaimer: I may use AI tools to edit / improve the blog , same as using a vehicle to travel (Or any new Technology) to improve the experience. The content provided is for informational and entertainment purposes only and does not constitute financial, investment, or legal advice. Always do your own research or consult a qualified financial advisor before making any financial decisions. The author or publisher assumes no responsibility for any actions taken based on the information presented.

Comments

Post a Comment